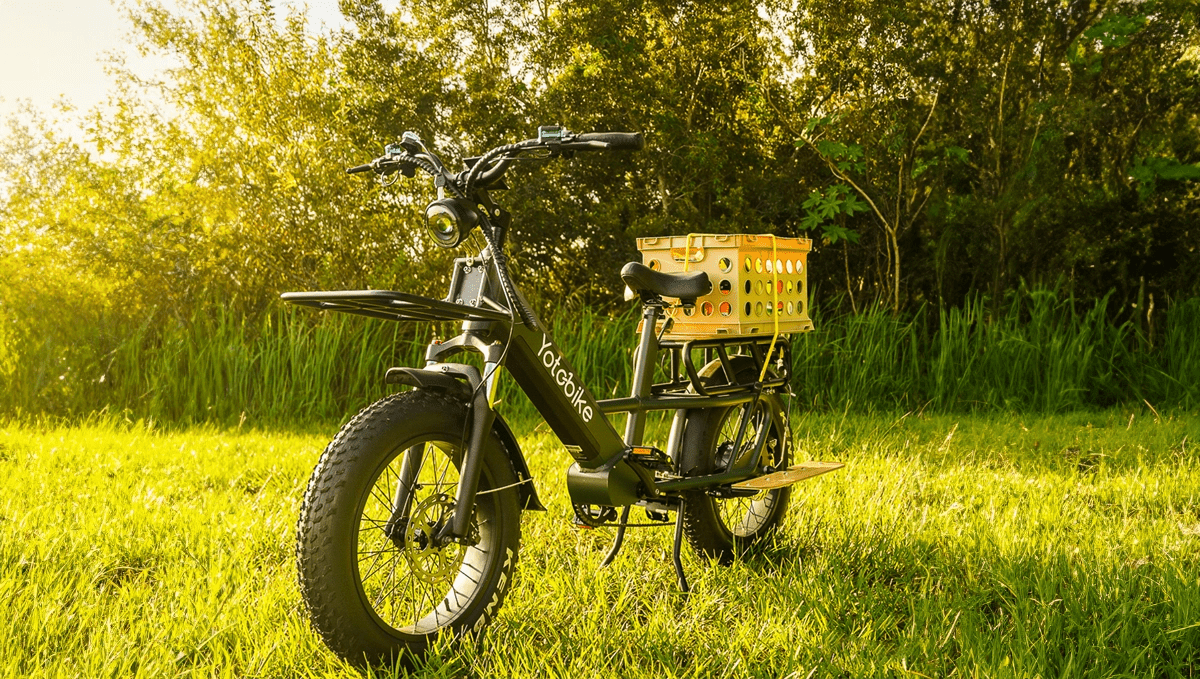

Buy now, pay later services are gaining popularity worldwide. Klarna is one such service, offering flexible payment options. This blog delves into Klarna installment plans, their benefits, eligibility criteria, application process, and tips for responsible use. Shop for an e-bike at Yotobike and experience Klarna's seamless process firsthand.

How Klarna Installment Plans Work?

Klarna installment plans offer an alternative payment method for customers seeking flexibility and convenience while shopping.

They allow shoppers to purchase items without making an upfront payment, breaking down the total cost into smaller, more manageable installments.

Here's a detailed look at how Klarna installment plans work:

- Retailer Partnership: Klarna partners with various retailers to provide customers with installment plans. These retailers integrate Klarna into their online checkout systems, making it available as a payment option during the purchase process.

- Choose Klarna At Checkout: When you shop online and proceed to checkout, look for Klarna as a payment option. If the retailer has partnered with Klarna, you'll see it listed alongside other payment methods like credit cards or PayPal.

- Create A Klarna Account: If you're a first-time Klarna user, you'll need to create an account. Provide your name, address, email, phone number, and date of birth. Klarna uses this information to perform a soft credit check, which does not impact your credit score, to determine your eligibility for the installment plan.

- Select An Installment Plan: Klarna typically offers multiple installment plans to choose from. These plans vary in duration, usually ranging from 2 to 36 months. The specific options available depend on the retailer and the purchase amount. Most Klarna installment plans are interest-free; however, some may charge interest depending on the retailer or the duration of the plan.

- Approval Process: After selecting a plan, Klarna reviews your information to approve or deny the installment plan request. This process is usually quick, taking only a few seconds. If approved, Klarna sends you an email confirmation with details of your installment plan, including the payment schedule.

- Making Payments: Klarna divides the total purchase amount into equal installments based on your chosen plan. Payments are due monthly, starting from the date of purchase. You can make payments through the Klarna app, website, or by setting up automatic payments using your bank account or credit card.

- Order Fulfillment: Once your installment plan is approved, the retailer processes and ships your order as they would for any other payment method. You'll receive your item(s) while paying for them over time.

- Payment Reminders: Klarna sends email reminders before each installment is due to help you stay on track with your payments. You can also view your payment schedule and history in the Klarna app or website.

- Early Repayment: If you want to pay off your balance early, Klarna allows you to do so without penalty. You can make additional payments or pay the remaining balance at any time through the Klarna app or website.

- Missed Payments: If you miss a payment, Klarna may charge a late fee. It's essential to contact Klarna's customer support and discuss your situation if you're struggling to make payments. They may be able to adjust your payment schedule or offer a solution to avoid late fees and negative credit reporting.

Klarna installment plans provide a flexible and convenient way to shop online, allowing you to spread the cost of your purchases over time. By understanding how they work, you can make the most of this payment option and enjoy a stress-free shopping experience.

Advantages Of Using Klarna Installment Plans!

No upfront payment: Klarna allows you to make purchases without immediate payment, offering financial flexibility. This feature can be particularly beneficial for large purchases, such as e-bikes from Yotobike, where upfront costs may be a barrier.

- Interest-Free Installments: Many Klarna plans come with no interest charges, making them budget-friendly. This advantage allows you to spread out payments over time without paying extra, keeping your finances in check.

- Boosts Credit Score: Timely Klarna payments can have a positive impact on your credit score. A higher credit score can lead to better loan terms and lower interest rates in the future, improving your financial health.

- Easy-To-Use Platform: Klarna's user-friendly platform ensures seamless transactions and account management. The platform allows you to track your payment schedules, view your purchase history, and receive payment reminders, simplifying the overall process.

- Widely Accepted: Klarna partners with numerous retailers, including Yotobike. The widespread acceptance of Klarna means you can enjoy its benefits across various online shopping platforms.

- Flexible Repayment Options: Klarna offers multiple repayment plans, catering to individual financial situations. You can choose plans with different installment frequencies and durations, tailoring the payment process to your needs.

- Increased Purchasing Power: Klarna's installment plans can enable you to purchase high-quality products, like premium e-bikes from Yotobike that may have been out of reach otherwise. This increased purchasing power can enhance your overall shopping experience.

- Enhanced Security: Klarna prioritizes data protection, implementing robust security measures to keep your information safe. The platform uses advanced encryption technologies and adheres to strict compliance standards, ensuring the safety of your personal and financial data.

- Customer Support: Klarna offers comprehensive customer support, addressing any questions or concerns you may have. This commitment to customer satisfaction helps build trust in the platform and fosters a positive user experience.

- Promotes Responsible Spending: Klarna's installment plans can encourage responsible spending by breaking down large purchases into smaller, manageable payments. This approach can help you maintain a healthy budget while still enjoying the products you desire.

Eligibility Criteria And Application Process!

Eligibility Criteria:

- Age Requirement: Klarna users must be at least 18 years old to create an account and use the service.

- Valid Email Address: A valid email address is necessary for account creation, communication, and payment reminders.

- Financial Standing: Klarna may perform a soft credit check to assess your financial standing and payment history, ensuring responsible use.

- Country Of Residence: Klarna is available in specific countries, and your country of residence must be supported to access the service.

Application Process:

- Choose A Retailer: Find a retailer that supports Klarna payments, like Yotobike, and select your desired products.

- Checkout: Proceed to the checkout and choose Klarna as your payment method.

- Create An Account: New Klarna users must provide personal information, including name, email address, and date of birth, to create an account.

- Verify Identity: To protect against fraud, Klarna may ask for additional information to confirm your identity.

- Select A Payment Plan: Choose from the available Klarna payment plans, considering your financial situation and preferences.

- Complete The Purchase: Confirm your order and payment plan. Klarna will notify you of the payment schedule via email.

Tips For Responsible Use Of Klarna Installment Plans!

- Understand The Terms: Read and understand the terms and conditions of your selected Klarna payment plan to avoid surprises.

- Budget Wisely: Plan your finances to ensure you can afford the installments without compromising your other financial obligations.

- Track Expenses: Regularly monitor your expenses and payment schedules to maintain control over your finances and avoid late payments.

- Prioritize Needs Over Wants: Use Klarna for necessary purchases, rather than indulging in impulse buys that could strain your budget.

- Set Payment Reminders: Utilize Klarna's payment reminder feature or set up calendar reminders to ensure timely payments and avoid late fees.

- Limit Your Use: Avoid relying on Klarna for every purchase. Limit your use to when it's truly beneficial to your financial situation.

- Pay Off Debt Early: If you can, consider making early or extra payments to reduce your outstanding balance and minimize financial stress.

- Maintain A Healthy Credit Utilization Ratio: Keep your credit utilization – the percentage of available credit used – low to maintain a good credit score.

- Communicate With Klarna: If you face financial difficulties and struggle to make payments, contact Klarna's customer support to discuss possible solutions.

- Review Your Account Regularly: Regularly review your Klarna account to ensure accurate payment tracking and identify any discrepancies or fraudulent activity.

Conclusion

Klarna installment plans offer numerous benefits, such as interest-free payments, increased purchasing power, and a user-friendly platform.

By understanding the eligibility criteria and application process, you can take advantage of Klarna's features while shopping at retailers like Yotobike.

To ensure responsible use, follow the tips provided to maintain financial health and make the most of Klarna's services. Happy shopping!